Founders need champions to support and help grow their early-stage ventures.

These early champions are often angel investors because they are usually the first to believe and invest in a startups’ vision, often before it is fully proven. Angel investors play a crucial role in the development of startups and even more are needed to support the growing and diversifying entrepreneurial ecosystems around the globe.

So, who are these angel investors today and what do we know about them?

Who Can be an Angel Investor?

An angel investor is an individual who invests his/her money in start-up companies in exchange for an equity share of a business. While only 300,000 individuals have made an angel investment in the past two years, there are over 4 million households that are eligible to invest in startups in the U.S.! While the angel investor sector continues to grow, there is still a huge opportunity for more investors to enter this space.

Who is Angel Investing Today?

Source: Angel Capital Association

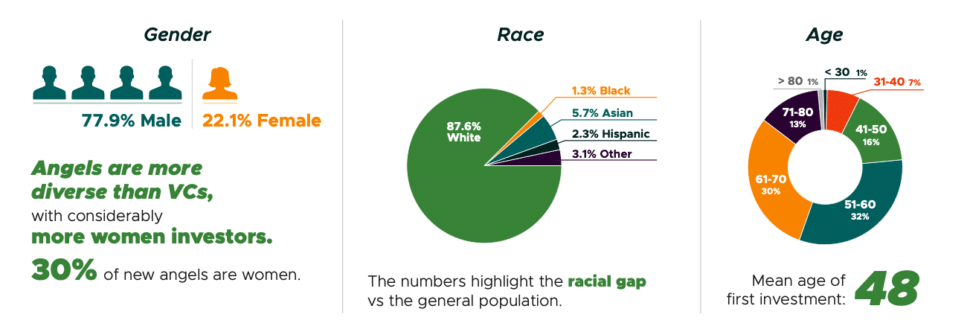

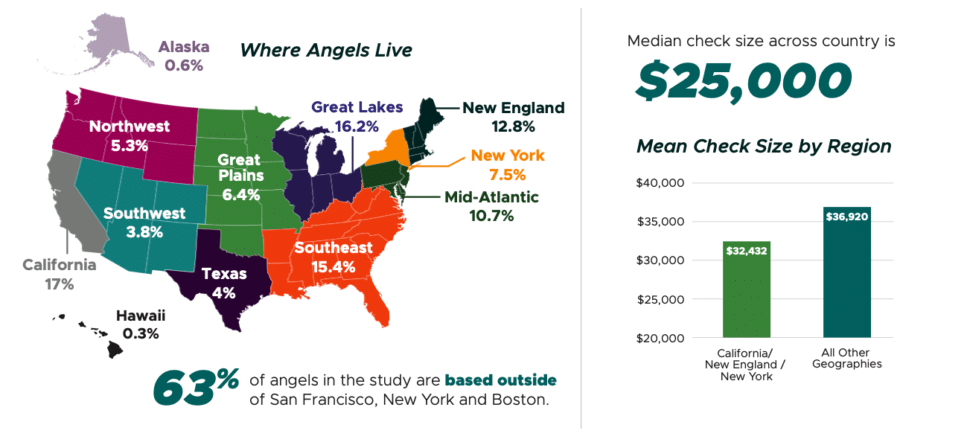

Current data shows that there is a large gender and racial gap among angel investors. As it stands, the ACA reports that only 22.1% of angel investors are women. Racial minorities account for only 13% of angel investors with Blacks and Hispanics accounting for 1.3% and 3.1% of these investors, respectively. Geographically, angel investors are located in every region of the United States with 63% of them being located primarily outside of San Francisco, Boston and New York. Among these geographical locations, the southwest has the lowest percentage of angel investors at 3.8%. Angel investors tend to invest in geographical clusters which indicates that entrepreneurs may have more success in finding investors closer to home rather than traveling to the few well-known, concentrated investing hubs.

While only 22% of women are angel investors today, that number has continued to increase since 2015. In comparison to VC, where women only account for 5-8% of U.S. venture capitalists, angel investing provides a greater opportunity for them to get involved in venture deals. Additionally, 51% of women respondents consider the gender of business founders to be important when making investment decisions in comparison to men at 6%. Lead researcher, Laure Huang, expressed that “This indicates that women are seeking to support women entrepreneurs”. Also, 2x as many women, in comparison to men, reported that they strongly consider the social impact of a startup when making investment decisions. However, both women and men angel investors align when it comes to the importance of ventures they invest in having a quality founding team.

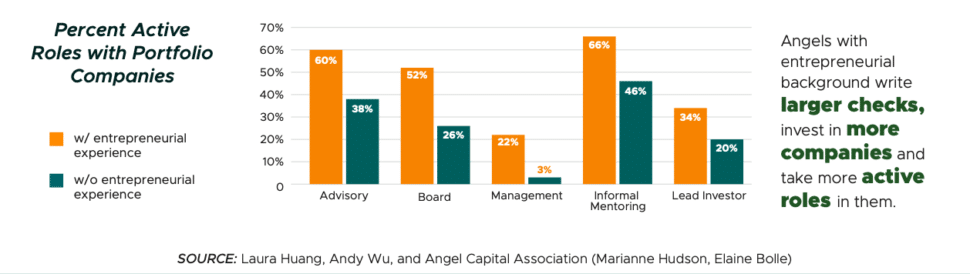

Insight from GEN Global and the American Capital Association also indicates that 54.8% of angel investors have prior experience as an entrepreneur themselves and typically play an active role with the startups that they invest in. Data also indicates that angel investors with entrepreneurial experience invest larger amounts of money in comparison to those who do not have entrepreneurial experience. The average check size for investors with entrepreneurial experience is $39,000 in comparison to $28,000 for others. In addition, investors with entrepreneurial experience have more companies in their angel portfolios and see greater returns.

How Anyone Can Start Angel Investing

Given the updates to the Regulation Crowdfunding rules, more people are getting the opportunity to invest in startups, even if they are not yet accredited investors. Companies like Republic, Crowdfund Mainstreet, SeedInvest, and other equity crowdfunding platforms are helping investors find vetted, early-stage deals where they can begin investing with as little as $10.

The Road Ahead for Angel Investors

There is a need for more people from all backgrounds to become angel investors. Only 7% of households that are eligible to make angel investments have committed capital into an early-stage founder’s vision. You might be one of them. Our work with Canyon Angels invites individuals from all backgrounds to learn more about the angel investing space if they meet the accredited investor criteria. Our angel investing training will guide you in finding investable, early-stage companies to add to your portfolio and it is one of the best ways to support innovation within the SEED SPOT community. You can be an early champion.